Tin Xu Hướng

Cách nhận 10TB TeleBox dung lượng miễn phí

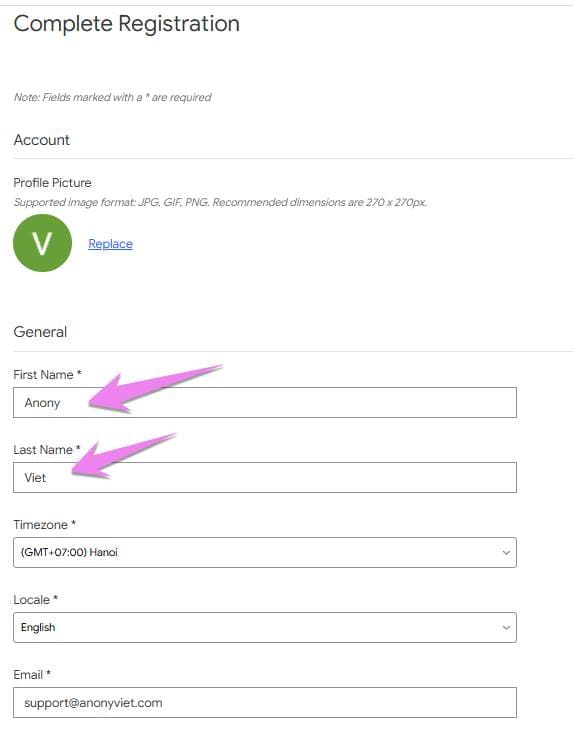

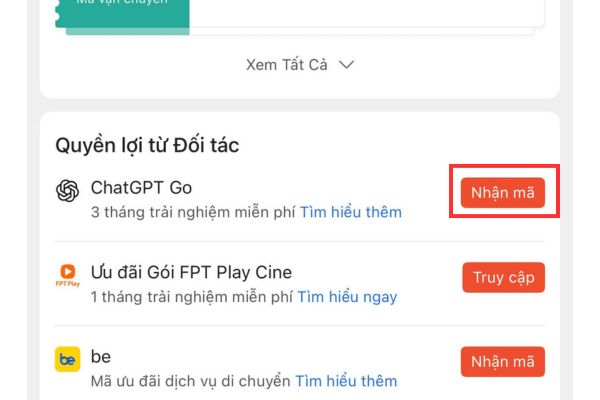

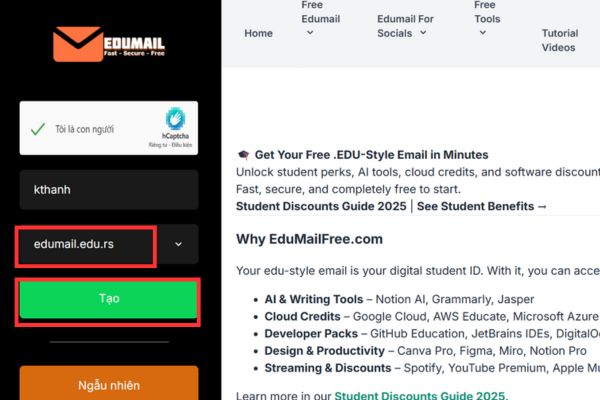

Cách nhận 10TB TeleBox miễn phí đang là một thủ thuật được cộng đồng mạng săn đón để giải quyết nỗi lo về không gian lưu trữ đám mây. Nếu bạn thường xuyên phải vật lộn với thông báo “bộ nhớ đầy” từ các dịch vụ khác, thì đây chính là giải pháp hoàn hảo. Bài viết này sẽ là kim chỉ nam, dẫn dắt bạn qua từng bước đơn giản để sở hữu ngay một kho lưu trữ khổng lồ một cách hoàn toàn hợp lệ. Hướng dẫn cách nhận 10TB Telebox miễn phí Bước 1: Sở hữu một email giáo dục (.edu) tạm thời Vì chương trình...

Đọc thêm

Cách tạo ảnh vừa chạy KPI vừa khóc bằng Gemini cho 12 con giáp

Cách tạo ảnh vừa chạy KPI vừa khóc đang là chủ đề được dân văn phòng tìm kiếm nhiều nhất những ngày qua để giải tỏa áp lực dịp cuối năm. Không chỉ dừng lại ở hình ảnh chú ngựa vật vã, trào lưu này đã lan rộng ra trọn bộ 12 con giáp với những biểu cảm “dở khóc dở cười” vô cùng sinh động và chân thực. Nếu bạn muốn sở hữu một bức hình “chính chủ” mang đậm dấu ấn cá nhân để bắt kịp xu hướng, hãy tham khảo ngay các bước hướng dẫn dưới đây. Trào lưu 12 con giáp và câu chuyện chạy deadline Sức hú...

Đọc thêm

Cách cập nhật địa chỉ cư trú trên VNeID, tránh bị phạt từ 15/12

Việc nắm vững cách cập nhật địa chỉ cư trú trên VNeID đang trở nên cấp thiết hơn bao giờ hết trước những thay đổi quan trọng về quy định hành chính sắp có hiệu lực vào cuối năm 2025. Thay vì phải lo lắng bảo quản các loại giấy tờ bản cứng, người dân hoàn toàn có thể tận dụng tiện ích của công nghệ để số hóa dữ liệu cá nhân ngay trên điện thoại thông minh. Quy định xử phạt mới liên quan đến thông tin cư trú Theo nội dung của Nghị định 282/2025/NĐ-CP, bắt đầu từ ngày 15.12.2025, các quy định...

Đọc thêm

Hướng dẫn tạo Gemini Enterprise miễn phí 30 ngày

Cách tạo Gemini Enterprise miễn phí 30 ngày đang là từ khóa “hot” nhất trong cộng đồng công nghệ khi Google bất ngờ tung ra gói ưu đãi cực khủng cho doanh nghiệp. Không cần thẻ tín dụng hay thủ tục rườm rà, đây là cơ hội vàng để các nhóm làm việc trải nghiệm sức mạnh AI hàng đầu thế giới mà không tốn bất kỳ chi phí nào. Hãy cùng đi sâu vào các bước kích hoạt đơn giản để tận dụng ngay món hời này trước khi chương trình kết thúc. Ưu đãi chưa từng có từ Google Google vừa thực hiện một bước đi...

Đọc thêm

Christmas Advent Calendar Giveaway: Săn phần mềm mỗi ngày trị giá $1.095

Christmas Advent Calendar Giveaway đang là tâm điểm chú ý của cộng đồng công nghệ khi mang đến cơ hội sở hữu kho phần mềm bản quyền khổng lồ hoàn toàn miễn phí. Thay vì phải bỏ ra số tiền lớn lên tới $1.095, người dùng có thể nhận về 25 công cụ hữu ích từ chỉnh sửa ảnh, video cho đến bảo mật hệ thống. Điểm nhấn của chiến dịch tặng quà mùa lễ hội Mỗi dịp Giáng sinh về, WinXDVD lại khuấy động không khí bằng những phần quà giá trị, và năm nay cũng không ngoại lệ. Điều khiến sự kiện lần này tr...

Đọc thêm

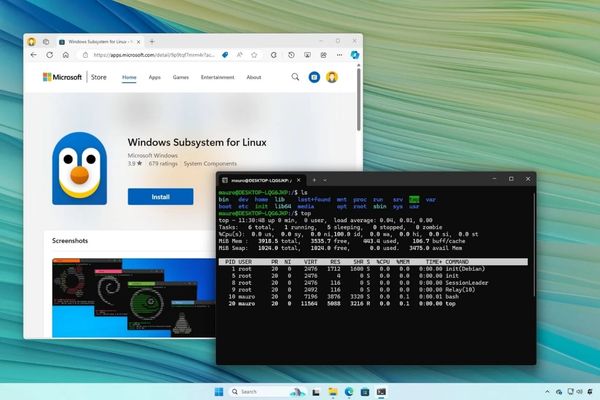

Cách gỡ cài đặt WSL trên Windows 11 một cách triệt để?

Gỡ cài đặt WSL trên Windows 11 có thể phức tạp hơn bạn nghĩ, không chỉ đơn giản là một cú nhấp chuột vào nút “Uninstall”. Dù là để giải phóng dung lượng, khắc phục sự cố hay đơn giản là không còn nhu cầu sử dụng, việc gỡ bỏ hoàn toàn đòi hỏi bạn phải thực hiện nhiều bước theo một trình tự nhất định. Đừng lo, bài viết này sẽ giúp bạn dọn dẹp Windows Subsystem for Linux một cách triệt để và an toàn khỏi máy tính của mình. Tại sao cần gỡ cài đặt WSL trên Windows 11? Windows Subsystem for Linu...

Đọc thêm